Schmuck of the Week: Martin Shkreli’s Trump Coin

Photo by Drew Angerer/Getty Images EconomyTrumpland Schmuck of the Week

Welcome to Splinter’s first subscriber-only column. My apologies to our esteemed OG subscribers for taking until now to do so, but grad school and the recovery from it occupied too much of my brain. Whatever we do for our subscribers has to be well thought out, and I did not have the mindset available to fully dedicate my best effort to it, but as soon as the fog of war lifted, an idea instantly emerged. There are so many schmucks out there, that betting I can find one per week to highlight in some level of detail for our readers seems eminently sustainable. The schmucks will come from all over the political, cultural, economic and sports spectrums, and their schmuckiness will range from jokey low-stakes stuff like this to more serious subjects should they arise. We are kicking this off with Splinter’s most famous previously incarcerated fan, Martin Shkreli, the famed “pharma bro” who spent the week becoming crypto Twitter’s main character. If you’d like to read the rest of this article and the Schmuck of the Week going forward (plus a sports subscriber-only column debuting soon), please subscribe to Splinter!

Ok the cheap schmucks are gone, it’s just us now. Thank you again for subscribing, it really means a lot as we try to rebuild this site that Herb did so much to destroy. Now that the mushy stuff is over, let’s get to the pointing and laughing.

So there’s this cryptocurrency called DJT, named after Donald J. Trump, but it is not the same as the stock DJT, which is a public company majority-owned by Trump. The crypto is worth a little over $100 million and the stock is worth $4.47 billion as of this writing.

Whether the crypto is actually connected to Trump is still a mystery, and the only “proof” provided to this point is Martin Shkreli claiming he and Barron Trump launched the coin together, and Pirate Wires, a libertarian technology, politics and culture website run by venture capitalist Mike Solana tweeted “Per conversations, Trump is launching an official token — $DJT on Solana. Barron spearheading.” Longtime Trump advisor Roger Stone said these claims were bullshit, and Shkreli fired back in classic Shkreli fashion claiming that it’s Stone who’s actually out of the loop.

Roger Stone doesn’t know Barron and is paid by another (fake and gay) Trump memecoin https://t.co/SWXgXsjcX6

— Martin Shkreli (e/acc) (@MartinShkreli) June 20, 2024

This is so incredibly stupid and schmucky. If Roger Stone, who looks like a one-off Batman villain from a 1970s comic book, thinks your scam is sad and low rent, you know you’re approaching something resembling rock bottom.

Keep in mind that Shkreli’s core claim of evidence he has supposedly produced over several hours of super normal Twitter spaces is that he is friends with a kid. And that kid told him that he could help make a crypto of his dad. This seems to be Shkreli’s genius plan to offload any personal legal liability while still profiting off it: the president’s son said we could.

Shkreli is on a short leash, and pump and dump schemes are not looked upon kindly by the federal government and its various enforcement branches, especially if you are currently on parole.

important complementary info:

• holder #1 is Raydium Concentrated Liquidity with 43% of the supply

• 46% of the supply is held by one cluster, with AxJcErA5 sending $DJT to 140 walletshttps://t.co/DT37IQR2Hd pic.twitter.com/8orOghCZQc

— Bubblemaps (@bubblemaps) June 17, 2024

This is the nice thing about crypto, and what gives me hope it could one day facilitate a more egalitarian and transparent economy despite the clusterfuck of greed that currently defines it: if insiders are amassing huge amounts and selling them, we can see that. If Shkreli is the creator of DJT, then it’s likely these wallets are either him or someone connected to him.

ZachXBT, who is the most notorious white hat on-chain hunter in crypto, turned his Sauron-esque eye on DJT, and claimed a $150,000 bounty offered by a deanonymizing company called Arkham to identify its creator. ZachXBT is not infallible, but he is well intentioned, and if he is saying something is real in crypto, then that’s as close to confirmation as you’re going to get.

One of the large DJT insiders verso.sol dumping $832K worth of DJT and then depositing USDC to CEX ~1 hr ago

Coincidentally also a large holder on Martin’s other project Shoggoth

5cPzLzLQjt2oc8X6rGannrh7HmVJNAMFJKq21DdZRuHP https://t.co/1uJyZ6ydAC pic.twitter.com/uKz6AAAcKu

— ZachXBT (@zachxbt) June 19, 2024

If Shkreli is right and this is Barron Trump spearheading this effort, this will likely bring the SEC into this mess. If Shrkeli is behind these wallets, then he’s likely violated his parole. Arkham paid out the bounty to ZachXBT, further buttressing the most credible party’s credibility here. This has not made Shkreli any more normal, and I write this, Shkreli and ZachXBT are fighting over the provenance of Solana’s newest meme coin losing people lots of money.

uh yeah we told our friends, including tate

— Martin Shkreli (e/acc) (@MartinShkreli) June 21, 2024

He means Andrew Tate here, who a Romanian court has charged with rape and human rights violations. Criminals gotta stick together or something I guess.

Given Shkreli’s demonstrated fanboyism for Splinter, I reached out to him multiple times, and will write a follow-up post should he ever get out of ZachXBT’s mentions and respond. We’ll close this Schmuck of the Week column by attacking our two titular schmucks where it really hurts, their wallets, while utilizing a skill I paid to learn in grad school. Let’s run some regressions!

Fun With R

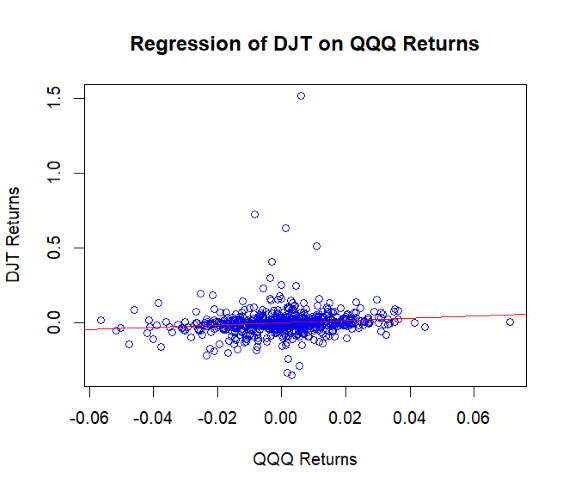

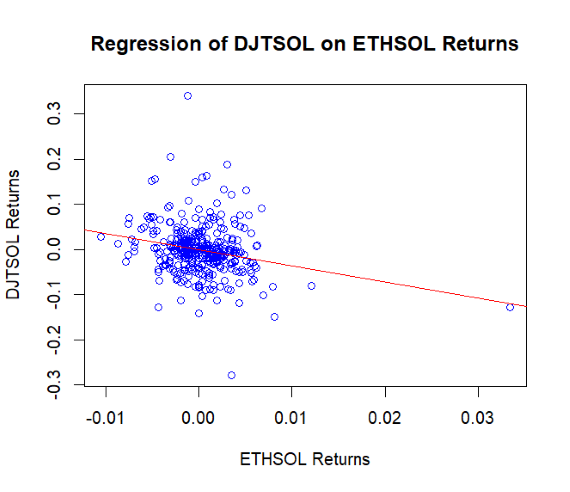

A regression is a simple way to compare independent variables to one another and find statistically significant relationships between them, and I learned how to run them in the open-source computer program R. In finance, utilizing a baseline like the S&P 500 is the standard, and then you can take the returns of other stocks to see how they compare to what is commonly defined as “the market.” We’re going to run regressions on both DJT the stock and the crypto. We’ll compare the stock to the Nasdaq (using QQQ as a proxy) since it is a tech stock, and the crypto will be run against Ethereum, which functions as something like an index for shitcoins.

Spoiler: investing in DJT isn’t great, folks!

The slope returned by the stock regression is 0.72, which means that for every one unit increase in the intercept (QQQ), that DJT will increase by 0.72, and the p-value is 0.00312. This is another way of saying the returns to date indicate that DJT should under-perform the Nasdaq by 28% and this figure is extremely statistically significant (defined as a p-value under 0.05).

The blue circles in the chart below are DJT and QQQ returns on the same day, and the red line is the slope of the regression. There is a positive correlation, but this is still not the up-only slope investors are looking for to try to beat the market. Not to mention, if you narrowed this scope to get rid of the outliers, removing the handful of circles above 50% DJT returns would drop that slope even further.

And that’s the good DJT to invest in! Shkreli’s scheme has a negative slope! This one is a bit trickier because it is brand-new, so the regression was performed in increments of fifteen minutes, and the only data Tradingview had for it was DJT/SOL, so we will compare it to ETH/SOL.

For every one unit increase in ETH/SOL (ie: when ETH goes up by 2% versus SOL going up by 1%), the regression analysis indicates that the DJT will decline by a whopping 3.59 (359%!!!!) and the p-value is an extremely confident 0.000025. Crypto is trending sideways and kind of down right now, so the overall market isn’t great, but DJT is vastly under-performing its benchmark. Look at this regression line, it’s in freefall!

Congratulations Martin. In such a short time you have already done so much for Splinter between giving us free press in the middle of a crypto bro meltdown, to providing us with the perfect fodder for our first ever Schmuck of the Week. I sincerely hope that you find a way to stay out of prison through all this mess, because there are no rules about multiple time Schmuck of the Week winners.