Did the Stock Market Just Fire a Warning Shot at Trump?

Photo by https://www.rawpixel.com/image/5926718, CC0, via Wikimedia Commons

Disclaimer: Whenever I lean on my finance degree to talk about the stock market it is obviously not financial advice

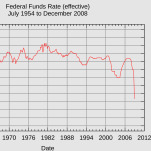

The Federal Reserve cut interest rates by a quarter point yesterday, continuing their policy pivot away from the higher for longer interest rates they used to combat inflation. The Fed determined that inflation had peaked, and the threat had receded to the point where they did not think they were making the same mistake as policymakers made in the 1970s by easing too quickly, and thus potentially causing another spike in inflation.

But this was no celebratory cut, as the market experienced its worst ‘Fedsday’ since 2001, as the Dow Jones fell two and a half percent, the S&P 500 fell just under three percent and the Nasdaq fell a little over three and a half percent. Crypto is tanking hard as I write this, as Bitcoin fell a little over five and a half percent yesterday, and many shitcoins’ value has been cut by a third or more since Federal Reserve Chairman Jerome Powell spoke.

The most obvious reason why the market fell hard is at the last Fed meeting, they had indicated they were going to cut four times in 2025, but now, the Fed has reduced this projection to two. Why?

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-