Elizabeth Warren Calls for Immediate Interest Rate Cuts as Job Growth Falls Off a Cliff

Photo by Drew Angerer/Getty Images

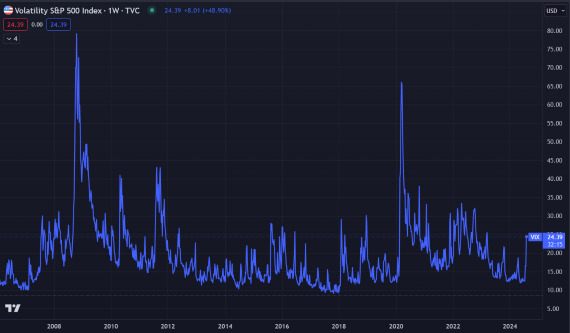

The VIX is a market volatility indicator that isn’t very useful from a predictive perspective, but it is from a descriptive one. For lack of a better term, it is the “shit hitting the fan” indicator for markets, and it was up as much as fifty percent today as it is currently sitting near levels that historically indicate things aren’t going so great (those two big peaks are the Great Financial Crisis and COVID).

Chart via TradingView

As of this writing, Amazon is down ten percent, as it disappointed on earnings and helped cause this market-wide cascade, but that is not the headline here. United States Treasuries, the “risk-free” fact at the base of neoliberalism’s lie, which for normal people purposes are important because they signal the market’s expectations for interest rates, are tanking too. The two-year rate is down over six percent, a massive daily move for a bond that is part of the largest, most liquid market in the world. The ten year is down just under four and a half percent, moves that are causing acute levels of pain to some bond managers around the world today, but are surely putting a big ‘ol smile on Senator Elizabeth Warren’s face as the market indicates it expects interest rates to fall hard.

Fed Chair Powell made a serious mistake not cutting interest rates. He’s been warned over and over again that waiting too long risks driving the economy into a ditch.

The jobs data is flashing red.

Powell needs to cancel his summer vacation and cut rates now — not wait 6 weeks. https://t.co/PmzEi45Ggi

— Elizabeth Warren (@SenWarren) August 2, 2024

To be clear, this is not a cheery situation. A Fed policy change in between scheduled meetings has precedent, but those precedents are ones that demand more urgency than the glacial pace of a backwards-looking institution by design. Today’s incredibly weak job figure, combined with slowing job reports over the last quarter, paint a pretty stark picture for the near-future of the U.S. economy, and Warren wants the Fed to take the chains off of it yesterday.

The reason the Fed hikes interest rates is to slow the economy down in order to tame inflation. That is the tried-and-true method to tackle perhaps economists’ greatest foe, but deflationary events are pretty bad too. We just have more tools to deal with them that all generally revolve around firing a gigantic money cannon at them. Lowering interest rates is one way to help load that gigantic money cannon to counter the more deflationary world we now find ourselves threatened by, as it reduces the cost of borrowing and incentivizes businesses to invest and make these ugly jobs charts look better.

Debates have been raging since the pandemic on how good the economy actually is, and many who have been making the case the economy is great have demonstrated a lack of understanding of economic reporting and the nature of tracking year over year changes. The initial surge in job growth post-COVID was simply relative to the bottom dropping out of the labor market during COVID, and today’s horrendous figure is relative to June’s lukewarm number in a more stable world.

This was a very common mistake that has colored wrong perceptions of our inflationary environment, as a one percent reduction in food inflation from 2023 to 2024 is progress, but in the context of an overall rise of food inflation of as much as twenty percent since 2021, that annual progress is miniscule. People who assert that things are getting more expensive are not being tricked by cynical lefties on social media, but simply reporting their lived experience in a more expensive world where the rent is too damn high.

The economy has grown in the last few years, with a huge assist from government spending like the Inflation Reduction Act, and should Trump win, Barclays and Morgan Stanley traders believe he may bring us the conditions that create stagflation, the worst thing that can happen to an economy and something that was once thought impossible until the 1970s came along. The United States out-performing every country post-COVID speaks to the power of smart government spending, and whether we continue to do so will hinge on this year’s election.

So What Now?

There are two immediate threats to the economy that come to mind which could take this from a slowdown to something resembling a crisis. One is that the Shiller PE ratio, the price to earnings ratio based on average inflation-adjusted earnings over the previous ten years, prices this as the third-most expensive stock market in history, behind the peak of the 2021 bubble and the most expensive market ever during the 2000s tech boom. There is a huge wealth effect that has helped this post-COVID economy, both from this surging stock market and high interest rates creating easy money for big investors, so the question naturally becomes: what happens when both parties end?

The Fed already signaled they were going to lower interest rates at least one time this year, and Warren’s call to do it now combined with today’s massive move in the Treasury markets is all the writing on the wall fund managers need. The world of risk-free five percent profit is likely gone next month, or sooner if Warren gets her wish. The stock market bulls have been foaming at the mouth at the potential for these trillions of dollars of sidelined cash to move into the market, but slowing job growth and an insanely overpriced stock market relative to a hundred and forty years of history are not exactly ideal conditions to rush into equities. If the market pulls back, history tells us that wealthy people will hoard even more cash and decrease their level of overall investment, and boy howdy does the market have lots of room to pull back.

So what happens if the moneyed interests driving the market smash the sell button on stocks while they make less in interest off their cash? That should slow the economy down even further, which could exacerbate a problem that has already arisen.

In June I took aim at the Zerohedge doofuses for not understanding how bonds work, but acknowledged the truth at the heart of their typical “the sky is falling”-based analysis. It sounds weird to sympathize with the banks, but they got royally screwed over by the government handing them an avalanche of money in 2020-2021 that they could really only use to buy Treasuries yielding around one percent, then the Fed jacked up interest rates above five percent, instantly devaluing the hundreds of billions of dollars of Treasuries bought by banks around the country.

The Silicon Valley Bank crisis highlighted the problem at the heart of this issue, and where the Zerohedge idiots’ hallucinations meet reality. Holding massively devalued bonds isn’t really an issue so long as you can hold them to maturity, because you get your money back with interest. If you have to sell them before they mature, in order to, say, meet the cash demands of cynical Silicon Valley investors sparking a bank run, then it does become a problem when unrealized losses become realized. And there are A LOT of unrealized losses currently sitting on bank balance sheets.

The government launched the Bank Term Funding Program in the wake of the SVB crisis to try to help buy banks the time they needed. The government loaned banks money to shore up their short-term liquidity and it worked, as nearly all the one, two and three-year 2020-2021 bonds that banks were underwater on have matured by now, and they avoided the calamity of becoming forced sellers of distressed assets.

But the BTFP expired in March, and while a lot of short-term disaster has already been avoided, banks operate on longer timescales, with the ten-year note typically being the keystone of their bond portfolio, and those bought in 2020-2021 are still dramatically underwater. Lowering interest rates will help cut into these losses should they materialize, but the leveraged nature of the banking industry makes any kind of serious loss unpalatable. They are designed to lend money and recoup consistent income and generally try to be as efficient with their cash management as possible, and that all goes haywire the moment they have to start selling things they never planned to sell.

Today sure seems like a seminal day for markets, as the recent slowdown in hiring was confirmed with a very bleak July jobs figure, activating the Sahm Rule which has historically indicated we are entering a recession. Yields are plummeting, and pretty much everyone except for Apple holders and short sellers lost money today. The supposed vibecession was a common talking point among people who falsely claimed we were in a hyper-bullish economy, and now in order to keep this talking point going, they must find a way to counter the reality presented by actual recessionary indicators.