The Economy Is Flashing Warning Signs as the Stock Market Bubble Inflates

Photo by CNBC Screenshot

This could be a headline from 2007, and it was a “not since 2007” statistic which spawned the research that led to this article. I am not saying we are on the precipice of another Great Recession, the whole point of the 2008 Great Financial Crisis is that institutionalized fraud was so endemic no one could see it coming until it was too late (save for a handful of analysts). Whether there is rampant 2008-style fraud in the financial system is not something I am privy to, but public data on the economy is, and this one highlighted by Bloomberg about the housing market got my attention: “Last month, the supply of new homes for sale increased to the highest since the end of 2007.”

This level of housing oversupply is still an order of magnitude smaller than its peak in 2008, but completed new single-family houses for sale are at levels nearly an order of magnitude higher than they were at the peak of the COVID crisis, and the line has been practically vertical since 2022, when the Federal Reserve began raising interest rates. The rent is too damn high and homes are way too expensive as normal people have been priced out of the idyllic American dream, and that is part of why the Federal Reserve is now beginning to lower interest rates. Add in the fact that commercial real estate has become its own kind of existential risk as it is predicated on a business model valued in a pre-pandemic world where people went into the office five days a week, and real estate of all forms poses a potentially significant downside risk to the economy.

But mortgage rates went up after the Fed pivoted, and for many homeowners as the Wall Street Journal noted, insurance and taxes actually cost more than the mortgage does, and “In September, 32 percent of the average single-family mortgage payment went to property taxes and home insurance, the highest rate ever for data going back to 2014, according to Intercontinental Exchange.” Despite having their best month since March, existing home sales are still on track to have their worst year since 1995. The housing market is frozen right now.

Stocks have dipped to end the year too, in response to an unexpected fall towards levels that are historically recessionary in the Conference Board’s index measuring consumer sentiment.

Expectations component in the Conference Board’s Consumer Confidence Index fell by 12.6 points in December … that’s the largest drop since November 2020 pic.twitter.com/OiGPIXw8T8

— Kevin Gordon (@KevRGordon) December 23, 2024

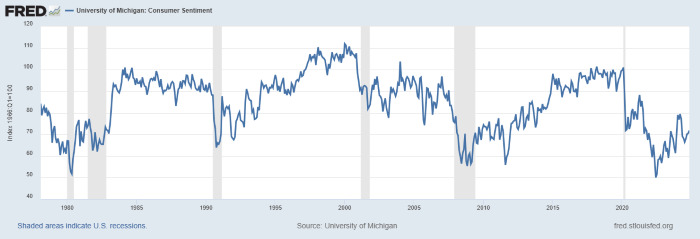

The University of Michigan Consumer Sentiment has been slowly ticking upwards, but it still remains at levels only seen in the wake of recessions in 2008 and the early 1980s and 1990s. The vibecession is real to a degree, but there are concrete reasons behind it.

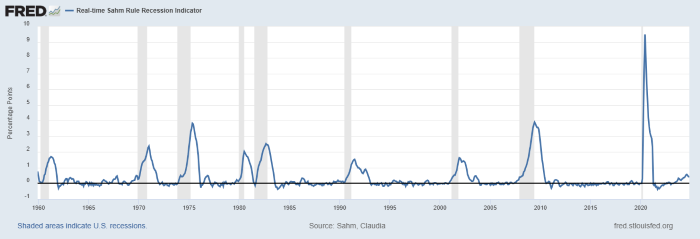

The number of people filing for new jobless benefits dipped last week, proving this labor market is fairly healthy, but it also revealed that people are remaining unemployed for longer, as continuous claims rose to a three-year high. There are some cracks appearing in the labor market, as exemplified by the Sahm rule being activated back in August on the heels of a really bleak jobs report. This most recent uptick in the Sahm rule chart below may look small in the larger context of its performance over time, but pay attention to the huge spikes during recessions (greyed out areas). They are typically preceded by small upticks that look like the current one we find ourselves in.

The Sahm rule has historically been perfect at predicting recessions ahead of time, although its inventor, Claudia Sahm, believes this time it may be wrong and that “a recession is not inevitable and there is substantial scope to reduce interest rates.” One problem with this analysis is that since she said this back in August, the Fed has cut its expectations in half for how much it will reduce interest rates next year.

Meanwhile, the Shiller PE Ratio, one of the gold standard metrics to gauge how expensive the stock market is, rose to its second-highest point ever recently, second only to the dot-com bubble in 2000. Bitcoin has been bouncing around $100,000, as its cyclical four-year bull cycle may be just around the corner, and we could be primed for a narrative-driven bull run of risk assets on the back of inflated expectations with a Republican trifecta about to take office.

This is not to suggest that we are on the cusp of a huge bubble and then crash like earlier this century. The fraud in 2008 did not begin in 2007 after all, as anyone who can remember Enron can attest. Markets and economies can be resilient right up until they aren’t, and if crashes were predictable, things wouldn’t fall so hard since people could prepare for them. What makes economic crashes so calamitous is the death spiral that cash hoarding creates as uncertainty mounts. Banks reduce risk which means reducing lending, and the people who depend on those loans all of a sudden don’t have money to pay other people, and thus the daisy chain of capitalism begins to burst as other weaknesses get exposed.

But it does make me nervous how expensive assets are and how different the conditions are from 2008 or even 2020, creating new kinds of uncertainty which can be its own kind of bear in a crisis. What really helped fuel the Great Financial Crisis was historically cheap credit, as the stripper owning five houses scene in The Big Short so helpfully demonstrated. The problem now is the opposite, where interest rates are the highest they have been in a couple decades, creating an affordability crisis in housing that is beginning to pile up a lot of unsold housing stock, exacerbated by a mounting insurance crisis driven in part by climate change, particularly in increasingly uninsurable Florida and other areas which find themselves threatened by more powerful hurricanes and rising tides created by climate change. The WSJ notes that a whopping 21.2 percent of homeowners in Miami went without home insurance in 2023. Once you start looking, there are a lot of tail risks to be found in the real estate market.

The question, as always, is what happens when the music stops. There is some hope for normal people in the housing market, as the median price of new and single-family houses sold has been on a bit of a downtrend over the last year, and sales of houses are well above their bleak 2008 levels. But prices are still extremely elevated and there is a standoff-like quality to everything in the housing market where it seems like we’re all just waiting for the other shoe to drop, but we don’t know what it is. The fact that core inflation actually rose over the past 12 months is also not helpful, as it was part of the reason the Fed cut expectations as to how many times they will cut interest rates next year.

This is all to say that the post-COVID recovery is still very much ongoing, and there are plenty of warning signs on the horizon that things may not be so rosy. Given that high level traders in the market are literally betting on Trump to bring higher inflation and lower growth, and consumer sentiment is currently near recessionary levels, it’s a fair question to ask whether these indicators are harbingers of a recession coming in our future.